[ad_1]

Financial literacy might be in all probability essentially the most underrated however essential talents that we may probably be educating our faculty college students in schools. It’s a potential often handed down from parents to children, significantly impacting a toddler’s future financial success. In relation to financial literacy, earlier education is better.

If dad and mother are financially literate and transfer these talents alongside, their youngsters normally are usually financially worthwhile themselves. Conversely, if dad and mother lack financial literacy or have poor financial habits, their youngsters will attainable inherit these poor financial habits.

We wish all of our children to succeed!

With this in ideas, financial literacy talents have an increasing number of develop to be acknowledged as an equity issue.

So, the place do schools and lecturers start? This weblog publish will share how any teacher can use the best financial literacy sources in the marketplace in order so as to add valuable financial literacy concepts to their curriculum.

What Can Colleges Do About Financial Literacy?

Balancing the equation of developing higher than you spend is crucial for financial success. Instructing these financial talents to our faculty college students is so important!

Numerous years up to now, my classroom was acknowledged as one of the most financially literate throughout the nation.

As I taught financial literacy talents, I discovered that whereas faculty college students had opinions about money, many lacked the info to make educated financial picks. This express experience involved an intensive simulation.

Whereas not every faculty can implement an in depth budgeting simulation, giving faculty college students some publicity to financial talents can have a long-lasting affect.

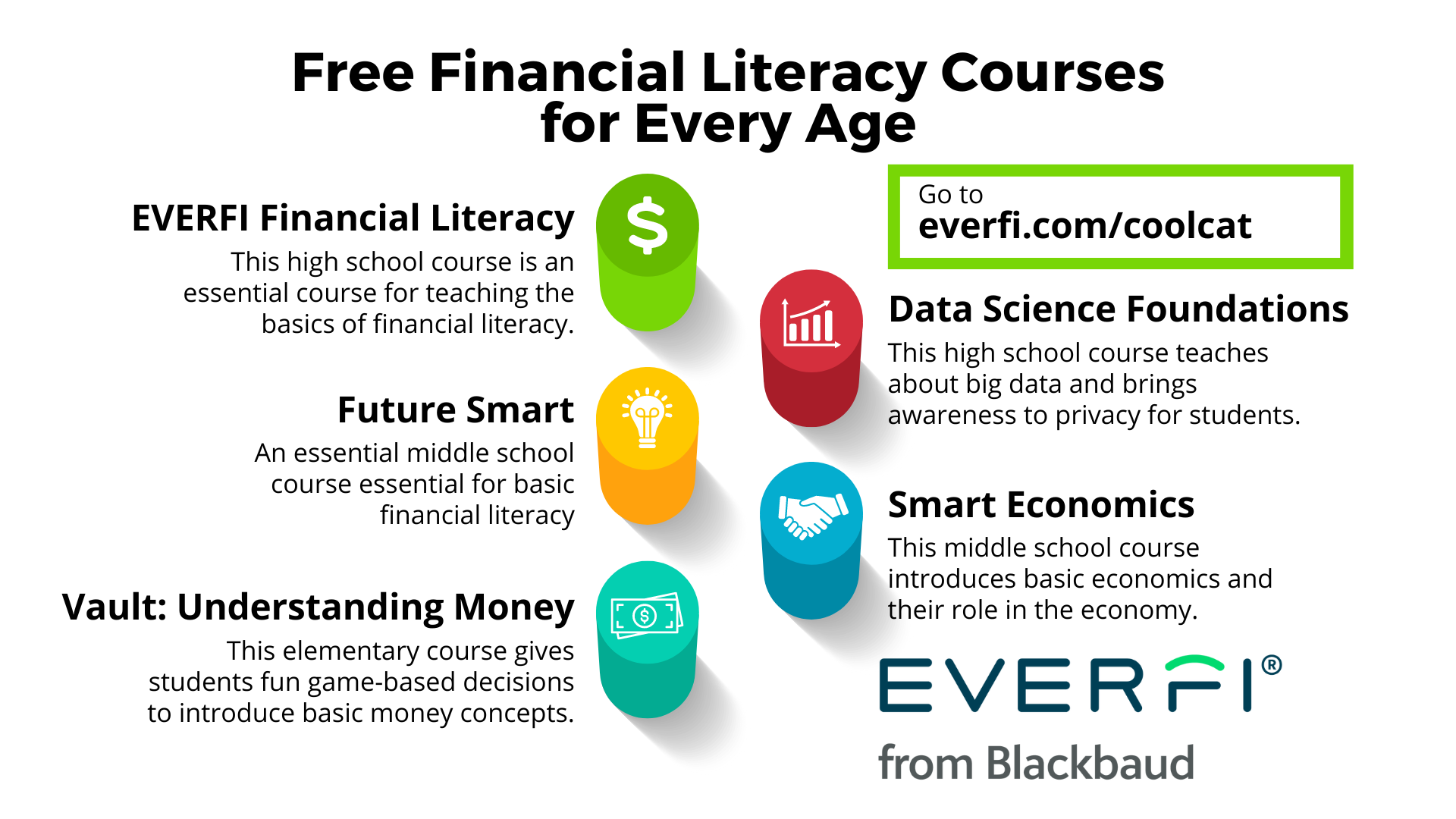

The packages shared on this publish simply do this. That’s the place EVERFI’s free packages can be found. With EVERFI’s solutions, you’ve got gotten a concise means in order so as to add financial literacy to solely about any course in your faculty.

Certain, Financial Literacy Can Be Put In Every Faculty

You probably can empower your faculty college students to develop to be financially literate at any age. By integrating financial literacy coaching into elementary, heart, and highschool curricula, we not solely equip faculty college students with essential life talents however moreover make math concepts further tangible and related.

On this weblog publish, I’m going to advocate some free packages on financial literacy and add one different important course on data analytics for highschool that may be related to financial literacy in the case of understanding how our on-line data is used.

All of these packages provide faculty college students hands-on experiences in decision-making simulations, providing invaluable finding out with out the hazard of real-world financial errors.

Benefits of these Free EVERFI Packages

- Each course is age-appropriate for the grade stage

- Packages embrace guides and superb teacher sources for using the packages with their faculty college students.

- Elementary math in these packages makes concepts like addition and subtraction rather more associated and real-world. We might like faculty college students to know that math is expounded to their regularly lives.

- The teacher dashboard lets lecturers monitor real-time in-course analysis data. This gives lecturers a picture of the place faculty college students are throughout the course of.

- The actions are game-based and real-world as faculty college students make picks and be taught regarding the penalties of those picks.

- The actions are compact adequate to go well with into your social science, math, economics, or completely different course as acceptable.

- All EVERFI courses come backed with an ISTE Seal and Digital Promise Product Certification.

Actually useful Financial Literacy Packages:

Listed below are the 5 financial literacy packages I imagine every faculty must look to implement. Many states have a requirement to point out financial literacy, and others are looking at together with it to their curriculum, so now’s the time in order so as to add this to your faculty’s curriculum.

1. EVERFI: Financial Literacy (High School)

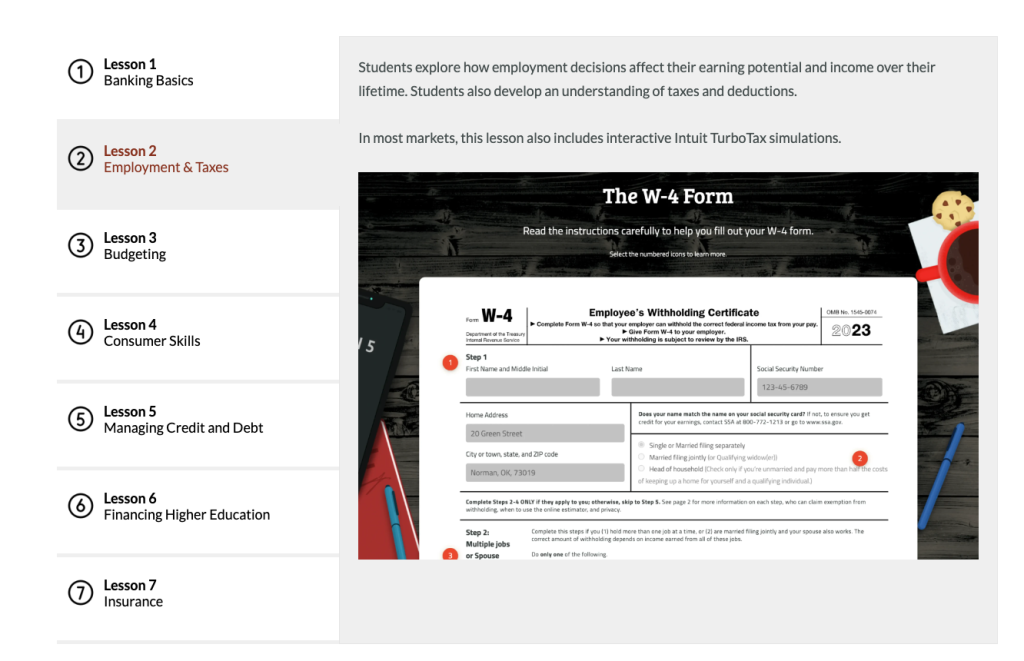

This fundamental financial coaching course should be taught to every highschool scholar. Made associated to highschool faculty college students particularly, this 7-lesson (35 minutes each) interactive course brings real-life conditions to varsity college students and has been confirmed to positively impact students who take the course.

Topics lined throughout the EVERFI: Financial Literacy course:

- Banking fundamentals, along with the financial merchandise supplied by banks

- The suitable technique to full a W-4 and (in most areas) interactive simulations that help faculty college students calculate taxes

- Budgeting

- Purchases and regularly financial picks

- How credit score rating scores work and the fees associated to financial institution playing cards

- Selections about extra coaching, earnings, and debt

- Insurance coverage protection picks, along with car insurance coverage protection and procedures in an accident

This course has interactive simulations and real-life conditions that help carry the true world into the classroom

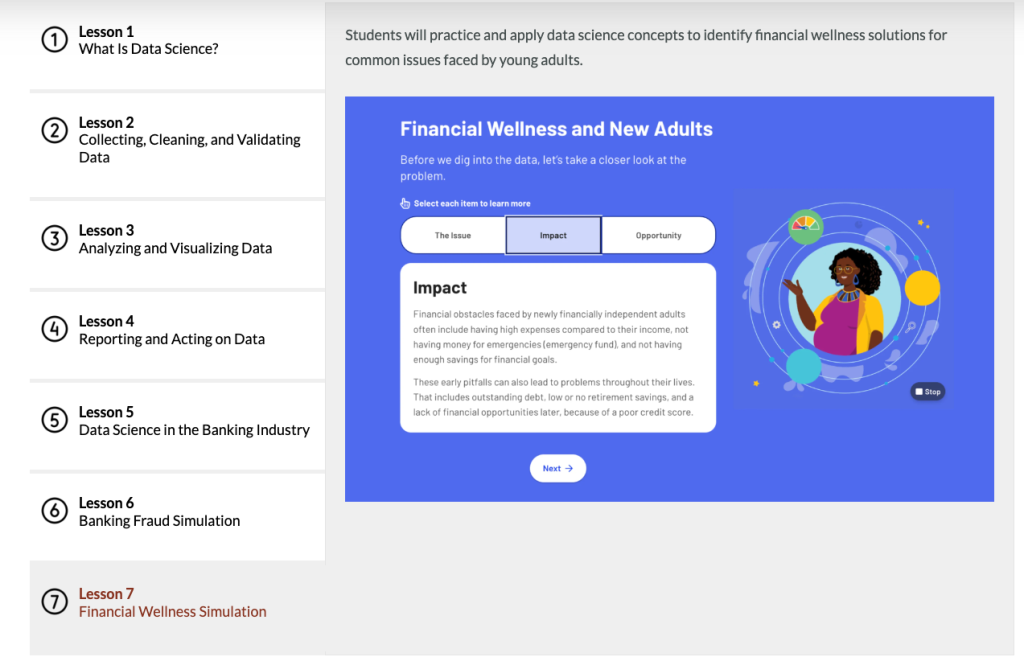

2. Data Science Foundations and Exploration Labs (Extreme Faculty)

Information science is an increasing number of part of financial literacy and is a rapidly rising career space. In in the intervening time’s data-driven world, understanding data analysis is crucial for educated decision-making. Data Science Foundations and Exploration Labs is an outstanding match for the highschool curriculum.

Topics lined in Data Science Foundations and Explorations Lab:

- Machine finding out

- Information visualization

- Database administration and data assortment

- Fields in data science

- How data is used

- Information science in banking

- Banking fraud and the way in which fraud is detected

- Widespread financial wellness factors for youthful adults.

By way of hands-on simulations and smart exercises, faculty college students understand giant data and the way in which their non-public data impacts greater data items. All of these examples are smart and real-world.

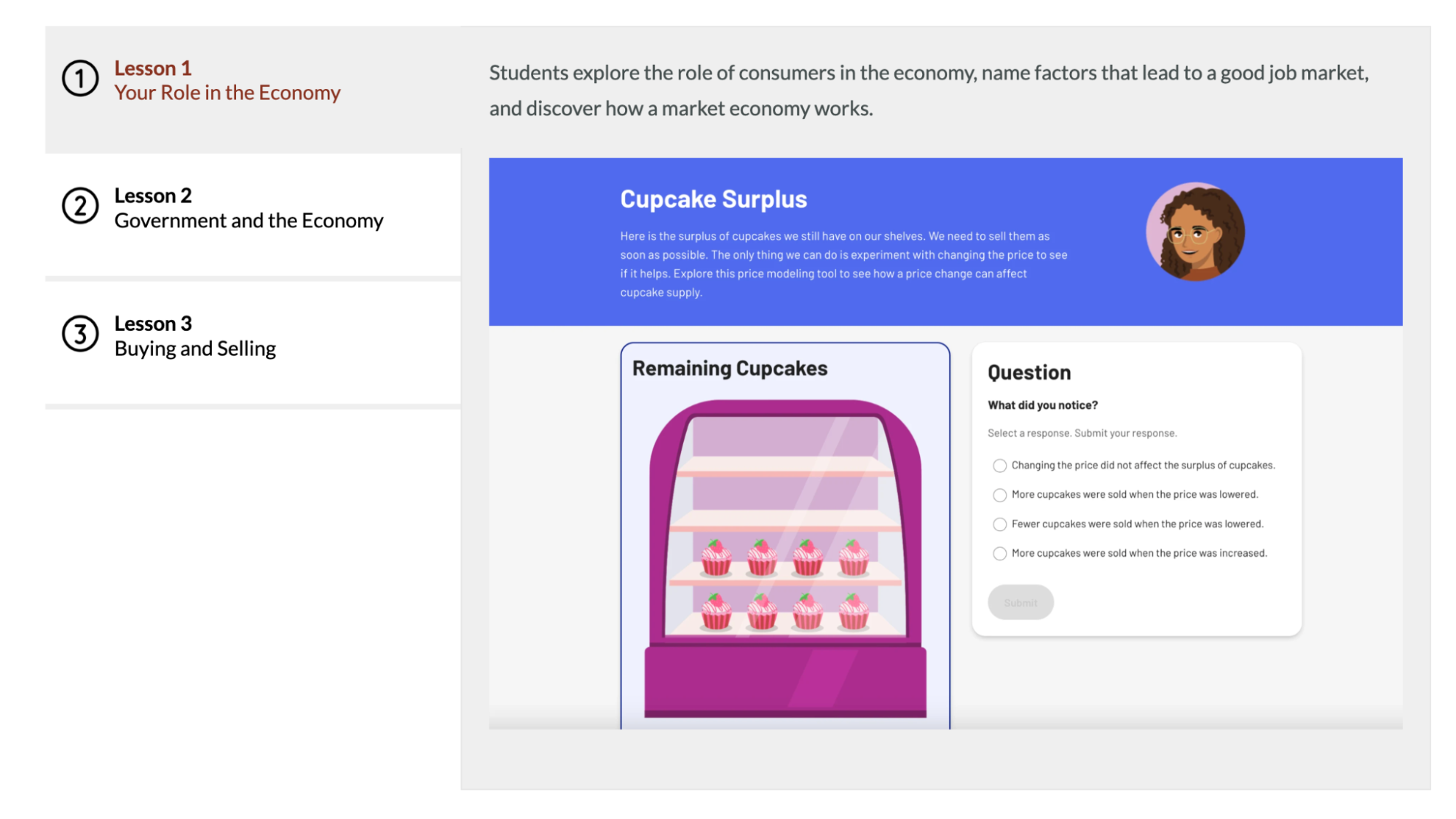

3. Smart Economics: Economics Concepts (Middle School)

Economics is a crucial course for heart faculty faculty college students to know their place throughout the financial system and grasp fundamental enterprise concepts essential for his or her future success. Smart Economics is an efficient start for heart faculty faculty college students.

Topics lined in Smart Economics:

- Purchasing for and selling

- Present and demand

- How markets work

- Authorities and monetary forces that type our world.

I moreover like this course because of many faculty college students will lastly work in enterprise. Enterprise ranges sometimes attribute economics packages, and I think about faculty college students needs to be uncovered to important economics knowledge earlier.

4. FutureSmart: Financial Literacy (Middle School)

FutureSmart helps faculty college students be taught to make real-life non-public financial picks in a hands-on story-based narrative with interactive exercises. This evidence-based course has been shown to increase the financial knowledge, financial confidence, and self-reported financial behaviors of heart schoolers compared with their buddies.

FutureSmart was independently validated to fulfill ESSA Stage III. This stage demonstrates that utilization of the digital course displays a constructive, statistically very important relationship with scholar’s financial knowledge, self-efficacy, and behaviors.

Furthermore, the Financial Industry Regulatory Authority (FINRA), current in 2022 that folks with elevated financial literacy seem to be greater prepared for short-term financial desires, report spending decrease than their income, and have an emergency fund put apart. So, this course might be on the excessive of my guidelines as an important addition to every heart faculty curriculum.

Topics lined in FutureSmart:

- Comparability shopping for

- Managing day-to-day payments, along with value methods

- Smart use of debit enjoying playing cards and financial institution playing cards and determining the excellence

- Occupation planning and income potential

- The suitable technique to reduce out-of-pocket costs of higher coaching

- How a enterprise grows its income

- Investments

- Insurance coverage protection

- Planning for sudden payments

- Creation of a personal portfolio of career pursuits, plans for furthering coaching, and subsequent movement steps

FutureSmart equips faculty college students with essential knowledge to make important financial picks that will affect their future, along with whether or not or to not pursue elevated coaching and the way in which to deal with associated costs responsibly.

Furthermore, this can be a superb time for lecturers to debate the affect of GPA and completely different elements from highschool as a result of it pertains to future career and coaching options.

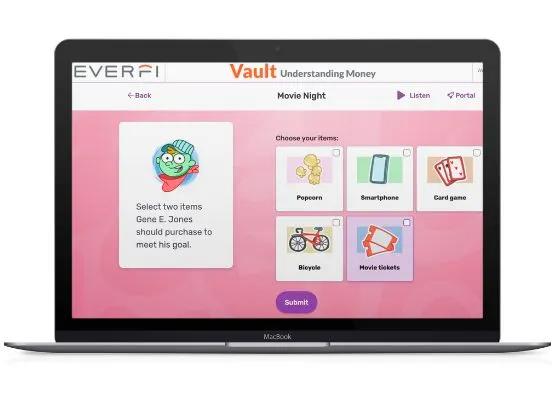

5. Vault: Understanding Money (Elementary School)

The Vault game-based experience introduces faculty college students to some main life talents in an age-appropriate means. Topics lined:

- Budgeting

- Occupation planning

- Healthful borrowing habits

Let’s Introduce Financial Literacy to All of Our Faculty college students

In conclusion, integrating these packages into your curriculum not solely makes math further vital however moreover items faculty college students up for a worthwhile future. By equipping them with financial literacy talents, we would assist break the cycle of poverty and empower them to make sound financial picks all by way of their lives.

Uncover the free, easy-to-use financial literacy packages offered by EVERFI in the intervening time. Your faculty college students’ future success is set by them.

Disclosure of Supplies Connection: This could be a “sponsored weblog publish.” The company who sponsored it compensated me by the use of cash value, current, or one factor else of value to include a reference to their product. Regardless, I solely advocate companies or merchandise I think about is perhaps good for my readers and are from companies I can advocate. I am disclosing this in accordance with the Federal Commerce Price’s 16 CFR, Part 255: “Guides Relating to the Use of Endorsements and Testimonials in Selling.”

In no way miss an episode

Get the 10-minute Coach Current delivered to your inbox.

[ad_2]

Source link